By Mustapha K. Darboe

On April 4, the Ministry of Information claimed on their Facebook page that revenue collections had surged by 134%, rising from D7.6 billion in 2016 to D17.8 billion in 2023.

Touting the achievements of the administration of President Adama Barrow, the Ministry attributed the revenue increase to “strategic reforms” at the GRA.

“These strides are a result of robust efforts in revenue mobilization and strategic reforms at GRA, aimed at strengthening compliance and broadening the tax base,” said a post by the Ministry of Information.

Analysis

The Gambia Revenue Authority collects two forms of revenue. They are tax and non-tax revenue.

In 2016, the GRA collected D7 billion in taxes and D600 million in non-tax revenues.

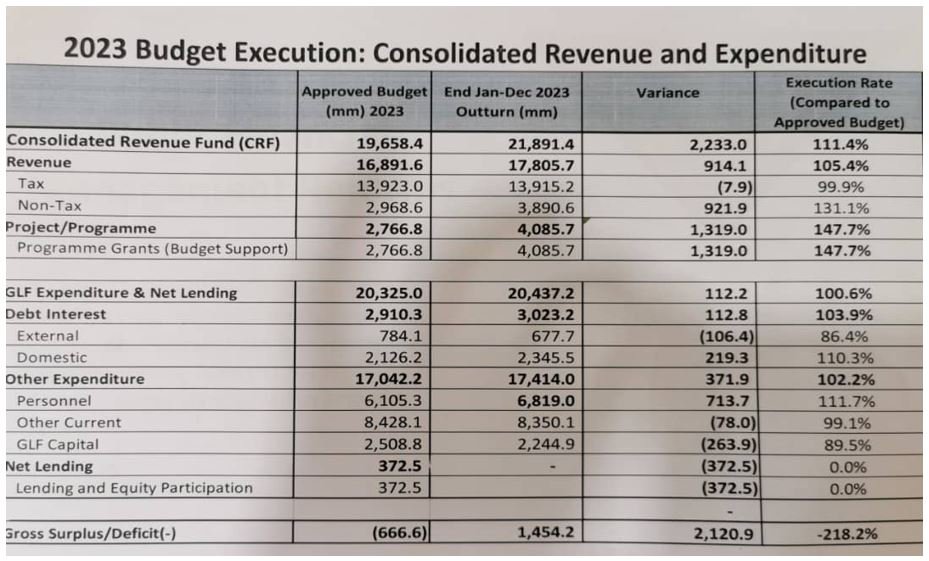

In 2023, the institution collected D13.9 billion in taxes and D1.740 billion in non-tax revenue. This brings the total to D15.6 billion, as was reported in the local newspapers.

This indicates an increase in collection of tax and non-tax revenue by at least 105%, climbing from D7.6 billion in 2016 to D15.6 billion in 2023.

The remaining revenue— D2.1 billion— which was calculated as part of the “revenue surge” includes money made from sale of the Mega Bank by the central government, and according to the finance minister Seedy Keita, a dividend paid to the government by the Central Bank of the Gambia. Keita confirmed this during a press conference at the Ministry on April 12, 2024.

The revenue generated from the sale of the Mega Bank cannot be calculated as part of the increase in “regular” revenue from “domestic sources”.

Conclusion: Therefore, regular revenue generated from tax and non-tax surged by 105% between 2016 and 2023.

The numbers published by the Ministry of Information includes revenue collected by the GRA, revenue from sale of Mega Bank and the ‘dividend’ from the Central Bank of the Gambia.